For instance, if Company A has $50,000 in cash and $70,000 in short-term debt, which means that the company is not well placed to settle its debts. For instance, a company with $200,000 in cash and marketable securities, and $50,000 in liabilities, has a cash ratio of 4.00. This means that the company can use this comprehensive income cash to pay off its debts or use it for other purposes. If the company is aggressively expanding its operations and taking on more debt to finance its growth, the D/E ratio will be high. Investors, lenders, stakeholders, and creditors may check the D/E ratio to determine if a company is a high or low risk.

What is considered a bad debt-to-equity ratio?

In some cases, investors may prefer a higher D/E ratio when leverage is used to finance its growth, as a company can generate more earnings than it would have without debt financing. This is beneficial to investors if leverage generates more income than the cost of the debt. The concept of a “good” D/E ratio is subjective and can vary significantly from one industry to another. Industries that are capital-intensive, such as utilities and manufacturing, often have higher average ratios due to the nature of their operations and the substantial amount of capital required.

- The company’s capital structure is the driver of the debt-to-equity ratio.

- Investors may want to shy away from companies that are overloaded on debt.

- For example, preferred stock is sometimes included as equity, but it has certain properties that can also make it seem a lot like debt.

- This is because the company must pay back the debt regardless of its financial performance.

Debt to equity ratio: Calculating company risk

However, if that cash flow were to falter, Restoration Hardware may struggle to pay its debt. Liabilities are items or money the company owes, such as mortgages, loans, etc. Investors can use the D/E ratio as a risk assessment tool since a higher D/E ratio means a company relies more on debt to keep going. Lenders and investors perceive borrowers funded primarily with equity (e.g. owners’ equity, outside equity raised, retained earnings) more favorably. While it depends on the industry, a D/E ratio below 1 is often seen as favorable.

Best for rate discount: Flagstar Bank

A high D/E ratio suggests that the company is sourcing more of its business operations by borrowing money, which may subject the company to potential risks if debt levels are too high. If interest rates are higher when the long-term debt comes due and needs to be refinanced, then interest expense will rise. A company’s management will, therefore, try to aim for a debt load that is compatible with a favorable D/E ratio in order to function without worrying about defaulting on its bonds or loans. Personal loans can also help you fund a new business venture, take advantage of a good investment opportunity or even increase your home’s value with home improvements. Understanding the risks and knowing how to use personal loans to build wealth can help you accomplish your financial goals. To calculate your company’s debt-to-equity ratio you’ll need your company’s total liabilities and shareholders’ equity.

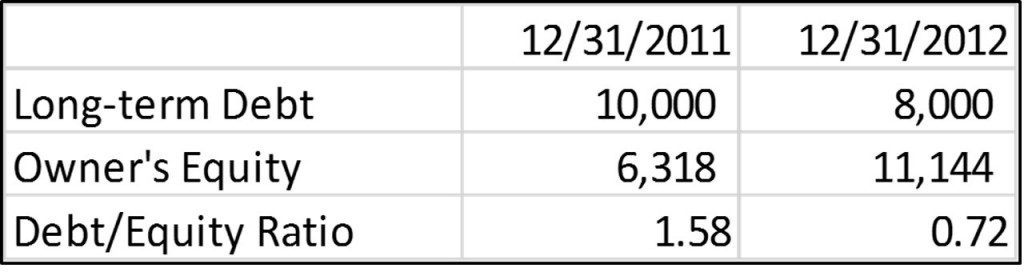

Like the D/E ratio, all other gearing ratios must be examined in the context of the company’s industry and competitors. Some analysts like to use a modified D/E ratio to calculate the figure using only long-term debt. It’s useful to compare ratios between companies in the same industry, and you should also have a sense of the median or average D/E ratio for the company’s industry as a whole.

This is a particularly thorny issue in analyzing industries notably reliant on preferred stock financing, such as real estate investment trusts (REITs). On the other hand, the typically steady preferred dividend, par value, and liquidation rights make preferred shares look more like debt. As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply. High leverage ratios in slow-growth industries with stable income represent an efficient use of capital.

A company’s ability to cover its long-term obligations is more uncertain, and is subject to a variety of factors including interest rates (more on that below). How frequently a company should analyze its debt-to-equity ratio varies from company to company, but generally, companies report D/E ratios in their quarterly and annual financial statements. They may monitor D/E ratios more frequently, even monthly, to identify potential trends or issues. Economic factors such as economic downturns and interest rates affect a company’s optimal debt-to-income ratio by industry.

Publicly traded companies that are in the midst of repurchasing stock may also want to control their debt-to-equity ratio. That’s because share buybacks are usually counted as risk, since they reduce the value of stockholder equity. As a result the equity side of the equation looks smaller and the debt side appears bigger. In addition, there are many other ways to assess a company’s fundamentals and performance — by using fundamental analysis and technical indicators.

Generally speaking, short-term liabilities (e.g. accounts payable, wages, etc.) that would be paid within a year are considered less risky. The term “leverage” reflects the hope that the company will be able to use a relatively small amount of debt to boost its growth and earnings. Wise use of debt can help companies build a good reputation with creditors, which, in turn, will allow them to borrow more money for potential future growth. Companies also use debt, also known as leverage, to help them accomplish business goals and finance operating costs. Calculating a company’s debt-to-income ratio requires a relatively simple formula investors can use on their own or with a spreadsheet.

To look at a simple example of a debt to equity formula, consider a company with total liabilities worth $100 million dollars and equity worth $85 million. Divide $100 million by $85 million and you’ll see that the company’s debt-to-equity ratio would be about 1.18. In other words, the company has $1.18 in debt for every dollar of equity. Using excel or another spreadsheet to calculate the D/E is relatively straightforward. First, using the company balance sheet, pull the total debt amount and the total shareholder equity amount, and enter these numbers into adjacent cells (e.g. E2 and E3). Debt-to-equity and debt-to-asset ratios are used to measure a company’s risk profile.

A debt-to-equity ratio that seems too high, especially compared to a company’s peers, might signal to potential lenders that the company isn’t in a good position to repay the debt. The interest rates on business loans can be relatively low, and are tax deductible. That makes debt an attractive way to fund business, especially compared to the potential returns from the stock market, which can be volatile. The company can use the funds they borrow to buy equipment, inventory, or other assets — or to fund new projects or acquisitions. The money can also serve as working capital in cyclical businesses during the periods when cash flow is low. Although it will increase their D/E ratios, companies are more likely to take on debt when interest rates are low to capitalize on growth potential and fund finance operations.